S&P Target Risk Indices Suggested as Benchmarks for Model Portfolios

Under Consideration

When comparing/analyzing model portfolios, often times a single benchmark such as the S&P 500 or Barclays US Agg aren't great fits if you're looking at balanced allocations.

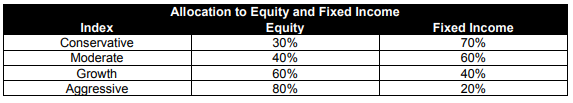

Our S&P Target Risk Indices are generally much better solutions, however many clients don't know they exist, how to find them, or what asset allocations they cover. I think if we included these as a suggestion within the '?' pop up it would be extremely helpful for our users. Something similar to the below:

Conservative - ^STRD

Moderate - ^STRB

Growth - ^STRC

Aggressive - ^STRA

If needed, additional info can be found on the factsheet and methodology reports on this page: https://us.spindices.com/indices/multi-asset/sp-target-risk-aggressive-index

I like this idea

I like this idea

Is there any chance we can add these indices on a total return basis?

Is there any chance we can add these indices on a total return basis?

Replies have been locked on this page!