Use Category Index or Custom Bench for Risk Calculations

Currently, risk metrics are calculated off of assigned asset class. However, our benchmark indices are not always accurate in relation to specific funds.

For example, JOGIX's broad asset class International Equity. It is assigned the MSCI ACWI ex USA Net Total Return bench in calculating risk metrics like Alpha and Beta.

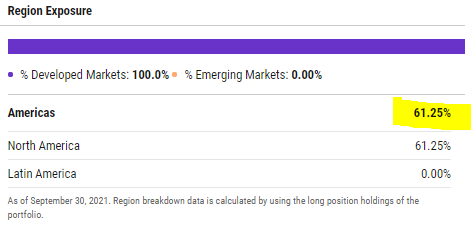

However, this fund has 61.25% exposure to North America and although it is categorized as International Equity, it is actually more so a "World Stock Fund" as it has large exposure to the US. To use a bench that excludes the US like MSCI ACWI ex USA Net Total Return does not make sense, and renders the risk statistics irrelevant.

I would suggest a more targeted/specific way of selecting the benchmark used for specific securities - using something more detailed than broad asset class. It would be helpful if we created versions of the risk metric that calculate off of the Category Index. For example, for the JOGIX example, we would calculate risk metrics using the category index which is MSCI ACWI Growth Net Total Return USD.

Or, simply assign more appropriate benchmarks - for example:

- MSCI EM index for EM funds, not ACWI Ex US

- Russell 2000 Value for Small Cap Value instead of the S&P

I do not know what the exact solution would be here... but this is a wide spread issue that has been coming up time and time again with both US and Canadian clients.

I like this idea

I like this idea

JOHCM - $21,000

Requested by: jlehning@johcm.com (Managing Director, head of US business development)

JOHCM - $21,000

Requested by: jlehning@johcm.com (Managing Director, head of US business development)

Replies have been locked on this page!